GPD: The Future of Global LNG Trade

As the global demand for cleaner power accelerates, LNG is emerging as the energy source of choice for regions beyond the reach of natural gas pipelines. This rapid growth has attracted new players to the industry, many of whom are looking for efficient and more flexible alternatives to the long-term sale and purchase agreements (SPAs) and bilaterally-negotiated master sales agreements (MSAs) which have dominated LNG trade for decades. These new entrants and regulators alike are calling for increased deal transparency, with prices generated openly in the marketplace instead of being obscured by retroactive pricing formulas linked to oil or refined products.

The Challenge

As the LNG sector tries to keep pace with the changing needs of its stakeholders, many remain frustrated by the absence of a futures contract, and the failure of the industry to adopt a contract with standardized general terms and conditions (GTCs) for the growing number of spot and shorter-duration transactions. Without these to vital commercial components in place, it will be difficult for LNG to reach its full growth potential.

The Solution

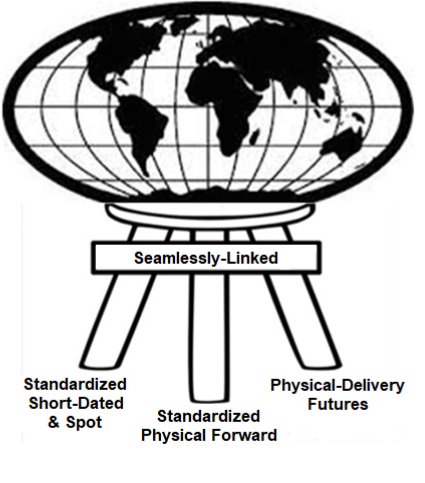

To solve the LNG contract standardization, price transparency and trading liquidity problems, GPD Systems, llc combines a crude oil-like pricing and delivery model, used successfully in the Brent cargo market for thirty years, with the GPD (guaranteed physical delivery) futures position matching patent (U.S. No. 7676406). Think of the solution as a “Three-Legged Stool” designed to standardize and seamlessly link trading in LNG spot, forward and futures markets.

The GPD solution offers non-commercials and hedge funds an exciting new platform to participate in the global price discovery process for natural gas, while providing LNG commercials:

- A reliable source or outlet for the physical commodity

- Counterparty performance guarantees

- Reduced basis risk and transaction costs

- Improved price transparency

- Enhanced trading liquidity

- Powerful new risk management tools

- Streamlined value chain economics